Dzmitry Dzemidovich/iStock via Getty Images

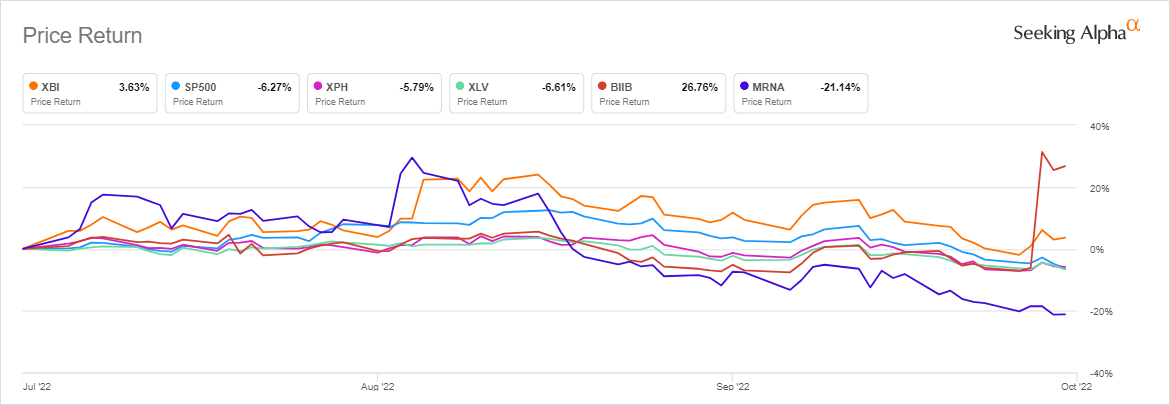

COVID vaccine makers lagged, and Alzheimer’s-themed stocks staged a late rally as U.S. biotech and pharma stocks outperformed the S&P 500 during Q3 2022 ahead of further catalysts. The equal-weighted ETFs SPDR Biotech (XBI) and SPDR S&P Pharmaceuticals (XPH) diverged in performance: The former added ~4% while the latter shed ~6% in Q3. Yet, both outperformed the S&P 500 and the Health Care Select Sector (XLV) ETF, which dropped ~6% and 7%, respectively, as seen in this graph.

Despite the YTD underperformance, Alzheimer’s stocks recovered in the final week after Biogen (NASDAQ:BIIB) and partner Eisai (OTCPK:ESALY) (OTCPK:ESALF) said that their anti-amyloid antibody lecanemab met the main goal in a large late-stage trial. The readout breathed new life into companies focused on the memory-robbing disease where there is an unmet medical need amid controversy surrounding the duo’s FDA-approved Alzheimer’s drug Aduhelm.

Among large caps, Biogen (BIIB) ended Q3 with a ~27% gain, while Cassava Sciences (NASDAQ:SAVA) among mid-caps added ~58%. Both stocks remain ~6% and ~32% lower in 2022, even as the Alzheimer’s space is positioned for further catalysts. Roche (OTCQX:RHHBY) (OTCQX:RHHBF) and Eli Lilly (LLY), which led U.S. mega caps, are expected to disclose Phase 3 data for their Alzheimer’s candidates in Q4 and mid-2023, respectively.

Alnylam Pharmaceuticals (ALNY) led the U.S. large-cap biotechs in Q3 with a ~35% rise. The shares of the RNAi therapeutics company spiked in August after announcing that its Phase 3 trial for patisiran reached the main goal against heart-related symptoms in the rare disorder ATTR amyloidosis.

Gaining ~16%, Regeneron (REGN) became the third best-performing large-cap biotech in Q3 as its blockbuster eye medication Eylea showed potential with a less frequent dosing regimen in two pivotal trials. New York-based company and its German partner Bayer AG (OTCPK:BAYZF) (OTCPK:BAYRY) expect to submit the data to global regulatory agencies.

Meanwhile, COVID-leveraged stocks were among notable laggards in Q3. Among mega caps, Pfizer (NYSE:PFE) led decliners with a ~16% fall, and Moderna (NASDAQ:MRNA) among large caps lost ~21% even as mRNA-based COVID vaccine makers won regulatory clearances for their Omicron-adjusted booster shots. The contract manufacturers to vaccine makers also fell in sympathy: Catalent, Inc. (CTLT) and Emergent BioSolutions (EBS) shed ~32% and ~34%, respectively.

Despite much-awaited FDA approval of its protein-based shot, Novavax (NVAX) lost ~68% to lag small caps after posting a substantial Q2 revenue miss and a sharp full-year guidance cut, citing a decline in demand and supply glut for COVID vaccines.

In September, WHO Chief Tedros Adhanom said that the end was in sight for COVID-19. Days later, U.S. President Joe Biden went a step further to declare that the pandemic was over, a remark widely attributed to a recent selloff among vaccine makers.

However, the trajectory of the pandemic continues to indicate potential catalysts ahead. While U.S. COVID metrics continue to fall, in Europe, the case numbers have risen for the second consecutive week, marking the first regional spike since the most recent BA.5 wave, the European Centre for Disease Prevention and Control (ECDC) reported Friday. The EU COVID data are among the closely followed globally as a rise in infections in the region has usually preceded similar spikes elsewhere.

Meanwhile, Verve Therapeutics (VERV) rose ~20% to lead mid-cap gainers as bullish ratings piled up on the clinical-stage biotech ahead of multiple catalysts for its lead candidate, VERVE-101. VERV and Beam Therapeutics (BEAM) were among notable mid-cap gainers and S3 partners ranked the gene editing firms among the top ten highly squeezable shorts.

The weight loss narrative also played out in Q3: Eli Lilly (LLY) bucked the sharp decline in mega-cap pharma ahead of more Phase 3 data for its experimental obesity therapy, tirzepatide, in 2023. Meanwhile, Rhythm Pharmaceuticals (RYTM) led the gainers among small-cap biotechs with over a fivefold rise, thanks mainly to promising Phase 2 data for lead asset setmelanotide in hypothalamic obesity.

Read about how European pharma stocks performed in Q3.

Image and article originally from seekingalpha.com. Read the original article here.