The Dow Industrials Average, a price-weighted average that tracks the performance of 30 blue-chip stocks, has outperformed the broader S&P 500 Index and the tech-weighted Nasdaq Composite Index in the year-to-date period.

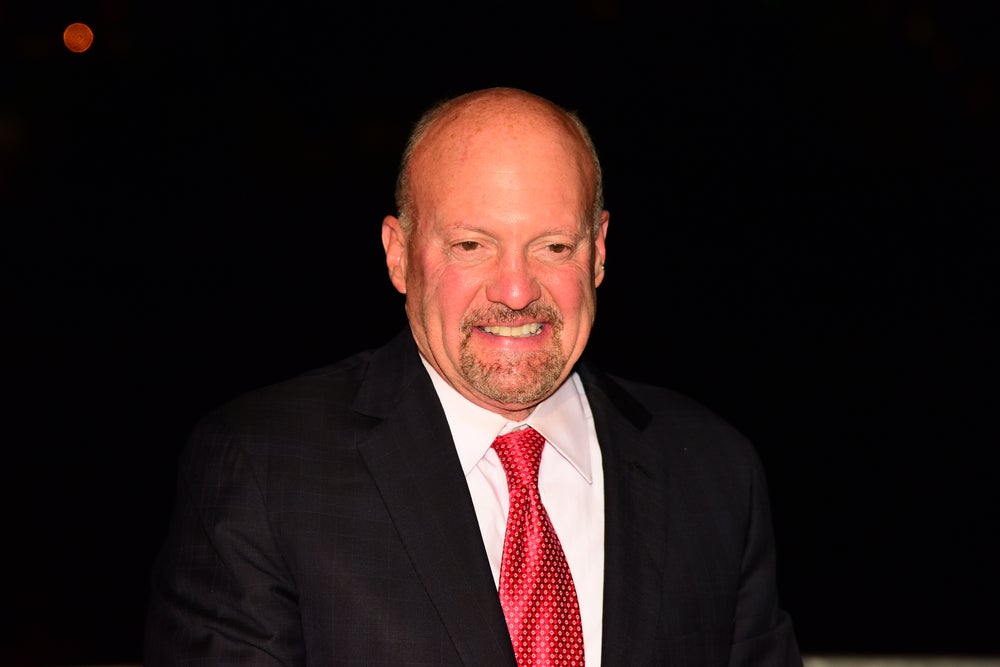

What Happened: This Dow’s outperformance would continue at least until January 2023 or a “lot longer,” CNBC’s “Mad Money” host Jim Cramer said on Monday. The stock picker outlined five reasons for the deduction.

- Recent data points that showed a let-up in inflationary pressure and the dovish Federal Open Market Committee minutes have cemented expectations that the Fed can pull off a soft landing.

- See Also: Bear Market? Resilient Investors Thronged Stock Market This Year Despite Mayhem, Shows Data

- Cramer expects several cyclical stocks in the Dow 30 Index to benefit from the bipartisan infrastructure bill and CHIPS Act.

- Supply chain problems faced by Dow 30 companies have appeared to ease.

- The recent modest retreat in the dollar is positive for the companies that constitute the index, given their large international exposure.

- Many Dow 30 divided stocks stand to benefit from the easing seen in long-term rates.

- Being “Old-Fashioned” Is Good? The primary reason why the Dow has fared better than the other two major averages is that it’s full of “old-fashioned, profitable” companies that return cash to shareholders, Cramer said.

- As opposed to the Dow, the S&P has a mix of both older names and newer ones, speculative companies and the Nasdaq Composite is dominated by the latter category, he added.

Top year-to-date performers among the Dow components are oil stock Chevron Corp. CVX and healthcare company Merck & Co Inc. MRK. These two stocks were up roughly 52% and 41%, respectively, for the period.

On the flip side, Intel Corp. INTC, Salesforce Inc. CRM and Walt Disney Company DIS were the biggest decliners.

Read Next: Best Consumer Cyclical Stocks