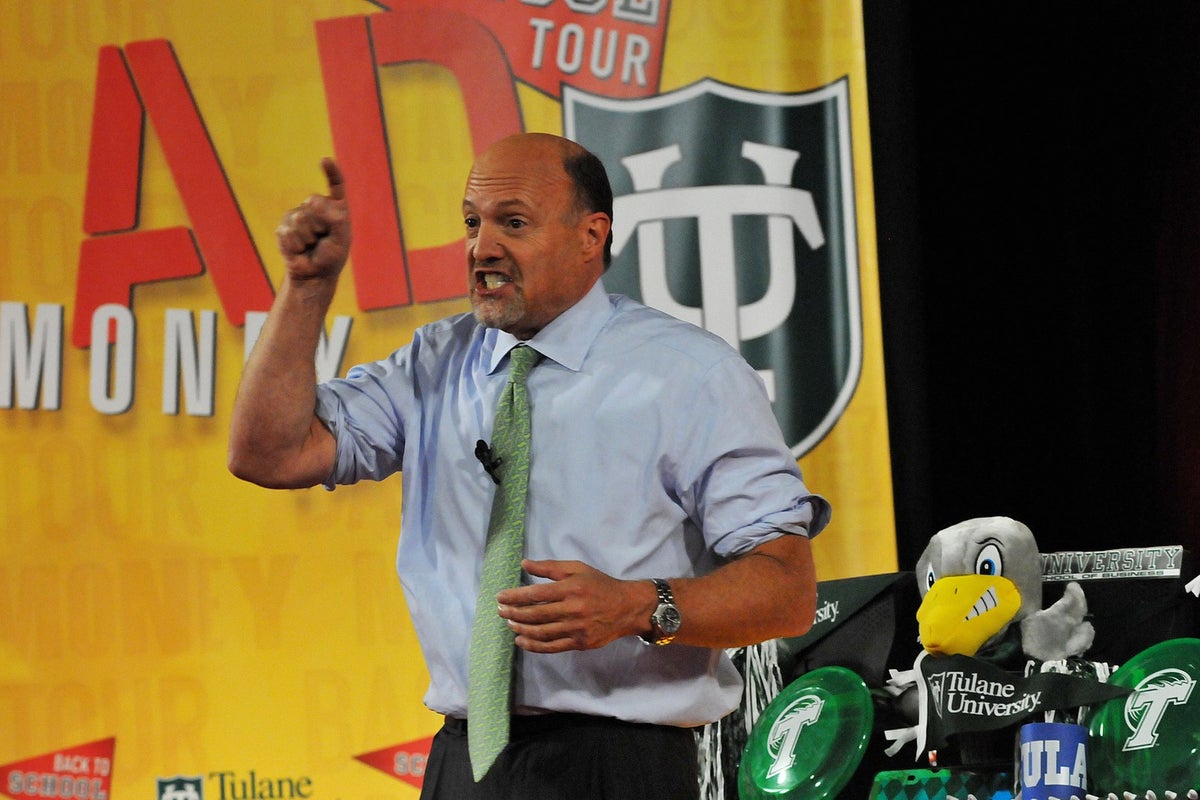

U.S. markets witnessed another sell-off on Thursday, dampening hopes of a “Santa Claus” rally following the temporary rebound. Prominent market commentator Jim Cramer highlighted three reasons behind the market fall on Thursday.

If the economy were running colder, if the stock market was lower, and if interest rates were higher before sliding, things would be different, Cramer said according to a CNBC report.

“Today we didn’t see that, though. We had the worst of three worlds,” he said. “While we could still get that seasonal bounce, obviously the market’s gotten tougher to game.”

Also Read: Gold IRA Kit

Major Wall Street indices closed over 1% lower on Thursday. The SPDR S&P 500 ETF Trust SPY closed 1.43% lower while the Vanguard Total Bond Market Index Fund ETF BND closed flat. Meanwhile, here are the factors that likely hurt the markets on Thursday:

1. Economic data: Initial weekly jobless claims for the week ending Dec. 17 rose by 2,000 to 216,000, the report said citing the Labor Department. The reading is lower than the Dow Jones consensus estimate of 220,000, it said.

2. Weak Corporate Results: CarMax, Inc KMX said its fiscal third-quarter revenue fell 23.7% year-over-year to $6.5 billion, which missed average analyst estimates of $7.42 billion. Micron Technology Inc MU reported first-quarter revenue of $4.08 billion, which missed average analyst estimates of $4.12 billion.

3. Expert Comments: David Tepper, founder and president of Appaloosa Management does not expect the Federal Reserve to veer from its course of action anytime soon. Tepper said he is leaning short on the equity markets.

Photo by Tulane Public Relations via Wikimedia Commons

Image and article originally from www.benzinga.com. Read the original article here.