By Len In General

Companies have different strategies to generate income. Aside from the normal operating activities, financing and investing activities should not be also set aside, especially if having positive contribution to the overall performance of the companies’ profit and cash flows. To better illustrate this idea, we analyzed EBAY and AMZN on their investments for the past 7 years.

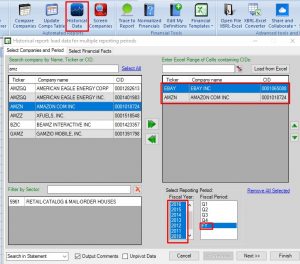

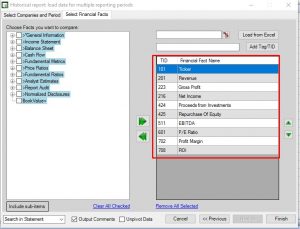

Using XBRLAnalyst, we got values on various accounts from their fiscal year filings starting from year 2010. We used “Historical Data” feature and chose some metrics and ratios to analyzed.

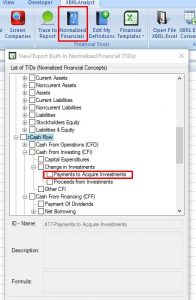

And since we are now focusing on their acquisitions, [Payments to Acquire Investments] is readily available in Cash Flows’ normalized financials. We added it and return the related values using XBRLFact function.

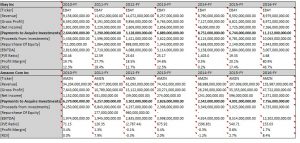

The result is below table with complete details for our analysis:

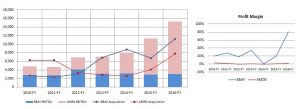

And of course, visualize the results using charts to easily understand both companies’ investing strategies in relation to their income, EBITDA, and the difference on their [Profit Margin] trend.

Comparing both company’s EBITDA to their Acquisitions, you would notice that though EBAY has lower or stable EBITDA trend, it has an upward acquisition trend. On the other hand, AMZN is undoubtedly having a bullish operating income trend since 2010, but not aggressive on acquiring new investments. These unlikely responses of both companies are better explained by the [Profit Margin]. Even having strong EBITDA, AMZN’s profit has not really moved that much for 7 years. While EBAY, though having almost steady EBITDA, has a really promising profitability.

Acquisitions should be carefully analyzed with utmost confidence on companies’ future returns. There maybe different ways on how management run the business, but there are also various ways to measure each decision. Maybe, you can check this article to confirm this or save this excel template to continue what we have started, but of course using the best Excel add-in tool XBRLAnalyst.

If you would like to try XBRLAnalyst for Excel or iXBRLAnalyst, just register for a test drive (no Credit Card required!)

If you need assistance building Excel models that leverage XBRLAnalyst tools, contact us at support@findynamics.com.

For video tutorials, visit our website or subscribe to our Youtube channel. To follow our posts and updates, please add our Twitter and Facebook accounts. For more information, please consult our Knowledge Base.

Image and article originally from findynamics.com. Read the original article here.