By Len In General

If there would be a number to keep track with banking sector, that should be related to efficiency ratio, the percentage of the bank’s net revenue as to operating cost. Aside from measuring the available revenue that can be set aside for taxes, dividends and future losses, efficiency ratio is also contributing to book value and share pricing. Meaning, the lower the ratio, the better it is.

Lets take these bank samples which were popularly held by hedge funds. As mentioned in the article, financial sector is expected to gain more for the coming months due to he support it is currently receiving. So lets check how efficient are their quarterly records starting 2011.

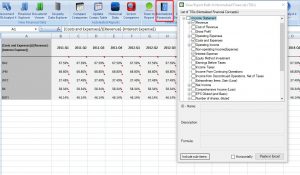

XBRLAnalyst in Excel allows you to return as many as available financial data in SEC database. With this feature, cumulative reporting periods can be easily retrieved and used for analysis. By combining various TIDs from Normalized Financials, we then returned all financial values related to revenue and expenses to create our required efficiency ratio. These TIDs are robust financial metrics which an be used to build simple and compound formulas in excel:

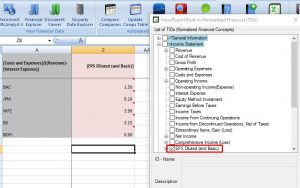

Then, add “Earnings Per Share”, one of its available financial tools.

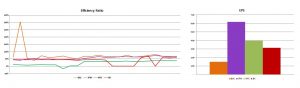

Plotting these data into chart, we can now determine the efficiency of each bank’s management:

These charts now describe which bank’s stock might be good for investment. We may have exampled for only 4 banks here, but by simply adding tickers to this template, you can start looking for your stocks. There are various financial tools integrated in XBRLAnalyst’s system which are always available to you. Check this complete list of XBRLAnalyst applications with given samples.

If you would like to try XBRLAnalyst for Excel or iXBRLAnalyst, just register for a test drive (no Credit Card required!)

If you need assistance building Excel models that leverage XBRLAnalyst tools, contact us at support@findynamics.com.

For video tutorials, visit our website or subscribe to our Youtube channel. To follow our posts and updates, please add our Twitter and Facebook accounts. For more information, please consult our Knowledge Base.

Image and article originally from findynamics.com. Read the original article here.