ArtistGNDphotography

Data released following the Black Friday holiday indicates consumers’ appetite to spend was not curbed amid elevated inflation.

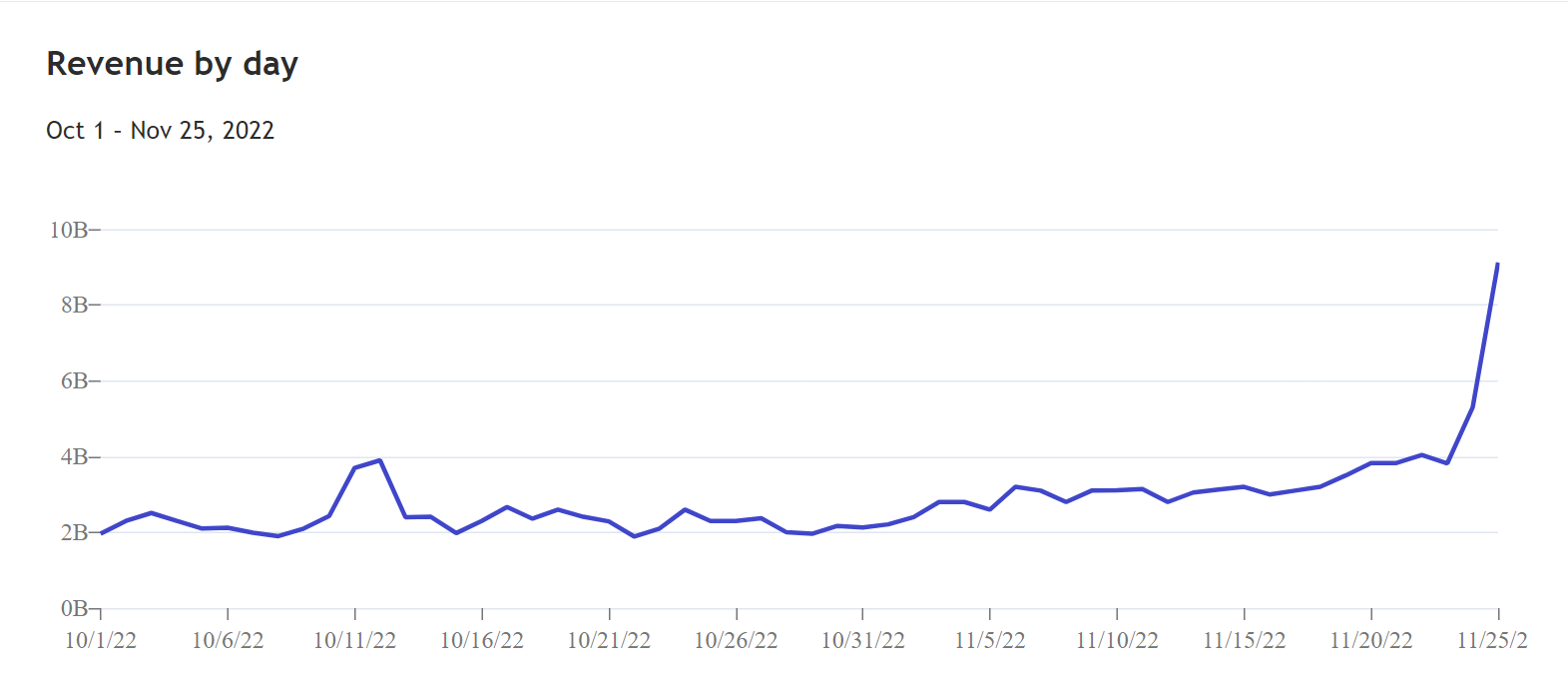

While traffic to malls may have been thinner than expected according to Reuters, web traffic remained robust. According to Adobe Analytics, shoppers in the US spent a record $9.12B on Black Friday sales online*.

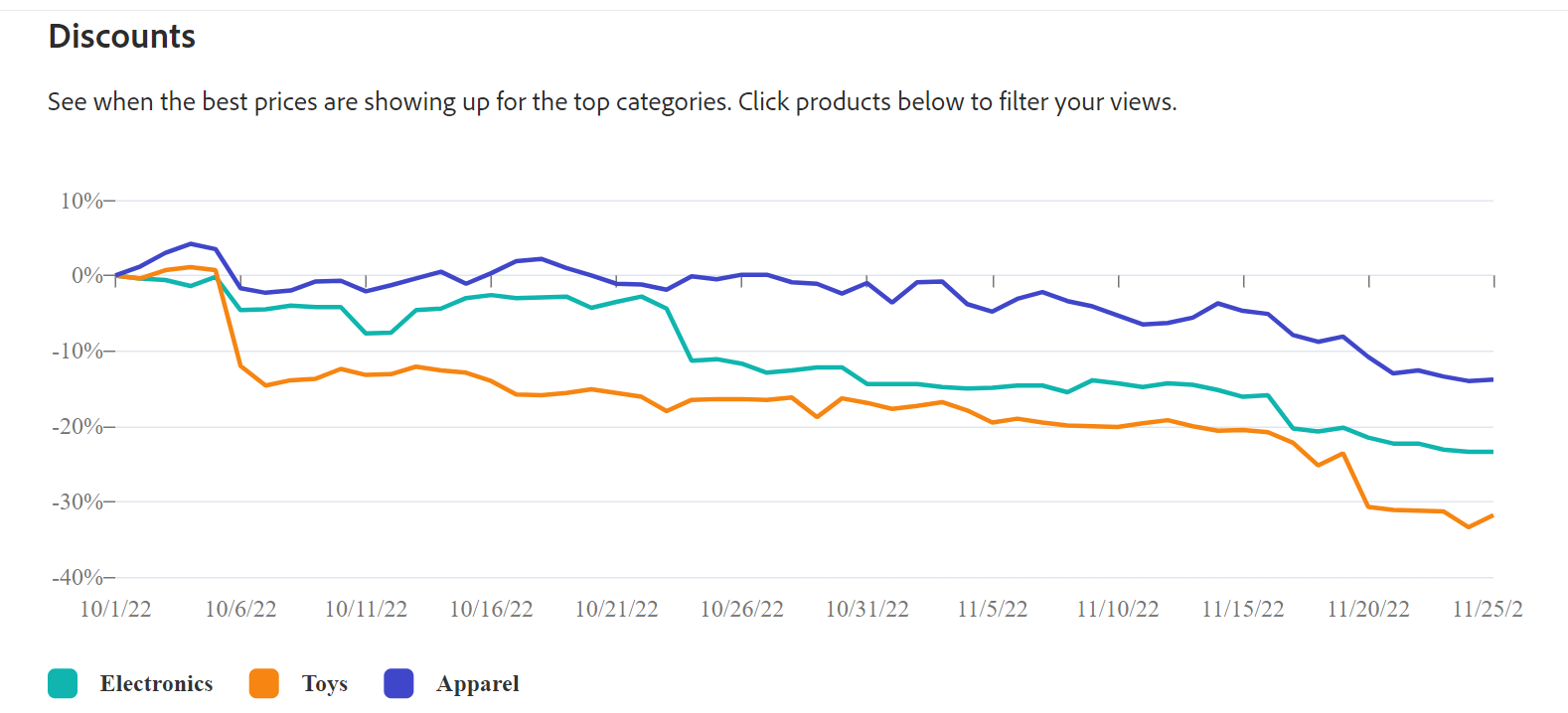

The record sales figure came amid deep discounting among many major retailers as the likes of Target (NYSE:TGT), Kohl’s (KSS), and more work through bloated inventory levels. Many retailers have been pursuing discounts earlier than ever due to inventory issues.

The 2.3% jump in online sales from the prior year more than doubled the expectation for the analytics provider. Additionally, Cyber Monday sales are expected to exceed the performance on Black Friday, adding to strength in the e-commerce industry.

The strong data from Adobe adds to a positive report from Shopify (SHOP). In a report released on Saturday morning, the Canadian e-commerce company said $3.36B was spent by consumers on the major shopping holiday, up 17% from the prior year. The peak hour for sales was around noon eastern time, wherein merchants on the platform saw $3.5M in sales per minute. The apparel, beauty, and home and garden categories led sales, according to Shopify as the average cart held about $102.31 worth of goods.

In-Store Overestimation?

The strength in e-commerce has pushed past expectations set by data providers such as Mastercard’s (MA) SpendingPulse, which had projected in-store sales to accelerate past online sales in the post-pandemic environment. The credit card provider had forecast a 15% jump in sales on Black Friday overall, led by an 18% rise for in-store retail sales. Department stores like Macy’s (M), Dillard’s (DDS), Nordstrom (JWN), and Kohl’s (KSS) were forecast to be some of the main drivers with year-over-year sales projected to rise over 25% amid a return of in-person shoppers seeking the aforementioned discounts.

“While retailers have already been heavily discounting this season, consumers and retailers are likely holding out for some special offers to land on the biggest promotional day of the year,” Steve Sadove, senior advisor for Mastercard (MA), commented.

The National Retail Federation estimated similar trends, projecting 166.3M shoppers through the long weekend, exceeding 2021 levels by 8M. The projection would also spell a record, according to the NRF, topping pre-pandemic levels.The Federation expected over 67% shopping in person on Black Friday, up substantially from pandemic-drive doldrums in the two years prior.

“While there is much speculation about inflation’s impact on consumer behavior, our data tells us that this Thanksgiving holiday weekend will see robust store traffic with a record number of shoppers taking advantage of value pricing,” NRF President and CEO Matthew Shay said. “We are optimistic that retail sales will remain strong in the weeks ahead, and retailers are ready to meet consumers however they want to shop with great products at prices they want to pay.”

According to early reports, however, in-person shopping trends remain muted. According to the Wall Street Journal, far fewer shoppers were out early for doorbuster deals than in years past. The deals found online appeared to stifle some appetite to deal with crowds on the typical busy shopping day, though complete data on store traffic trends akin to the readily-available online data has yet to flow through.

Discount Drivers

In terms of these discounts, Adobe data indicates that it is indeed the steep sales that are a key factor in driving sales to a year over year gain despite the inflationary pressure on consumers. Namely, electronics sales and toys were scooped up by shoppers that could not deny the discounts.

According to the NRF, toys like American Girl and Barbie dolls from Mattel (MAT) are top purchases for girls. Meanwhile, video games like ActivisionBlizzard’s (ATVI) Modern Warfare II and consoles like Microsoft’s (MSFT) Xbox and Sony’s (SONY) PlayStation dominate purchases for boys. Roblox (RBLX) was also cited as a top purchase on Thanksgiving Day by Adobe, which noted that sales on the Thanksgiving holiday itself also touched a record $5.29B.

Per Captify, an advertising technology company, consumers were well aware of the rampant discounting in the retail space and actively sought out these deals. As such, the selection of sites to target shifted from the prior year. The firm said that Walmart (WMT) usurped Amazon (AMZN) as the most-searched retailer for Black Friday deals. In fact, both Target (TGT) and Kohl’s Corporation (KSS) jumped ahead of Amazon in the search rankings as well.

Read more on how cold weather could carry robust retail sales through to Christmas.

* Charts provided by Adobe Analytics

Image and article originally from seekingalpha.com. Read the original article here.