designer491/iStock via Getty Images

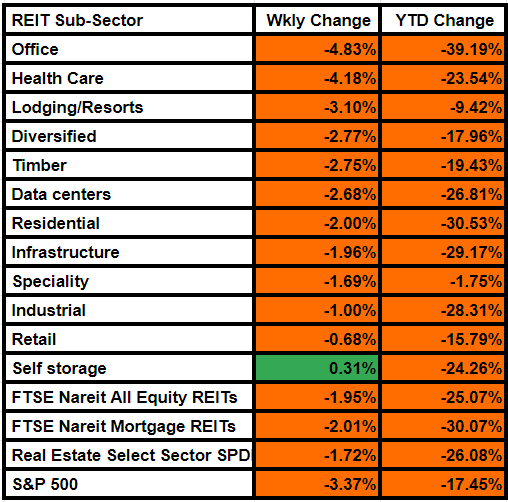

Equity REITs fell by 1.95% this week, compared to the S&P 500 index that was down 3.37% and the Real Estate Select Sector SPDR ETF that declined by 1.72% on a weekly basis.

Comparatively, mortgage REITs fell by 2.01% this week from last week as long-term mortgage REITs dropped amid increasing concerns over lackluster economic growth.

Office REITs were a major laggard, having lost 4.83% of their value from last week. Healthcare REITs lost 4.18% of their value this week.

REIT indexes saw a W/W decline in value after the news spread on Blackstone (BX) limiting redemptions from its $69B non-traded real estate income trust. CEO Stephen Schwarzman said this week that redemptions in the REIT were driven by investors roiled by market volatility rather than dissatisfaction with the fund, Reuters reported Dec. 7.

Self storage REITs were an exception, gaining 0.31% value compared to last week.

Bank of America Securities analyst Jeffrey Spector believes self storage REITs, especially CubeSmart (CUBE), will demonstrate resilient pricing power in 2023.

The analyst picked industrial, self storage and senior housing REITs in his 2023 outlook.

Here is a look at the performance of the subsectors this week:

Image and article originally from seekingalpha.com. Read the original article here.