primeimages/iStock via Getty Images

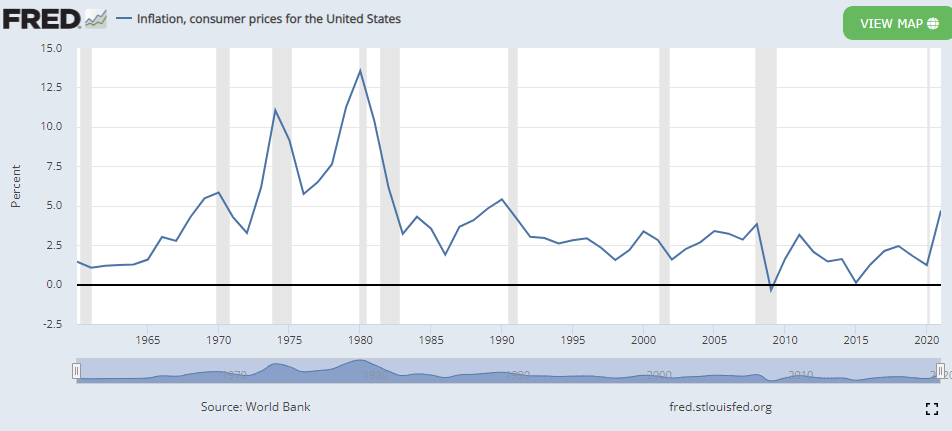

Last week’s inflation data — July’s consumer price index and producer price index — started to show some relief in rising prices, but the U.S. economy is still a far way off from reaching the Federal Reserve’s 2% inflation target.

In summary, consumer prices were flat from June to July and the July producer price index unexpectedly fell 0.5% from June, compared with a +0.3%. On a Y/Y basis, the CPI rose 8.5% vs. 9.1% a month earlier, and the PPI eased to 9.8% from 11.3%.

Much of the relief came from lower gasoline prices. The bad news is that the “stickier” prices such as shelter costs kept rising.

“So this month-to-month 0% increase is better than what we’ve been seeing, but there’s still a lot of worrying, underlying trends and inflation,” said Robert Frick, corporate economist at Navy Federal Credit Union, in an interview with Seeking Alpha.

“One of the more troubling things that I don’t think got enough analysis was food costs,” he said. Global upward pressure on grain prices is fueling baked goods prices. The avian flu has reduce the chicken flocks, and the U.S. milking herd is very low. “So you’re going to see a lot of stickiness in food costs,” which traditionally are fairly flexible — “but not this time around.”

Shelter costs, too, show no sign of moderating. “There just aren’t enough units, either rental or housing, in the country, and rents,” Frick said.

Ryan Sweet, senior director at Moody’s Analytics, sees rental inflation peaking “probably peak later this year.” To offset that, goods prices, the apparel, electronics, new and used vehicle prices — “they need to start declining to offset that rental inflation.”

The good news is that there a “pretty strong pipeline” of multifamily units, i.e., apartments, in the works. “So there will eventually be an increase in supply, which will put some downward pressure on rents in about 12-18 months. But the next few months are going to be pretty, pretty rough,” Sweet said.

Frick said July’s inflation moderation resulted from global factors, rather than domestic ones, chiefly the decline in energy prices. Global components account for about three percentage points of the 8.5%-9% CPI rate, he said. So if those pressures subside, inflation can come down to 5% or 6%.

While the equity markets cheered the lower-than-expected CPI print on Wednesday — the S&P 500 gained 2.1%, snapping a four-session losing streak — the Federal Reserve isn’t expected to pause its rate hikes anytime soon.

No celebrations yet: “From the Fed’s perspective, they’re not popping champagne corks yet,” Moody’s Sweet said. “Inflation is still very, very elevated.” Neither Frick or Sweet, though, see a recession as imminent.

“So recession will happen at some point, but I don’t think it’s imminent for this year or early next year,” Sweet said. The inverted yield curve signals a recession in the next 12 to 15 months. “But outside the yield curve, the economy look fine,” he said.

“Recessions are inevitable,” Frick said. And with this tightening cycle, “a soft landing would be a miracle.” A best-case scenario would have inflation come down on its own, resulting in a mild recession with a minimal loss of jobs. He puts a 20%-30% probability of a recession within the next year, but after that “there’s an extremely high probability of recession in 2024.”

Strong jobs outlook: While there have been worries about the labor market, the unemployment rate is still very low at 3.5% in July. “Job growth is very strong, so as long as the job market holds up, we’ll be able to skirt a recession,” Sweet said.

He expects the Fed to boost its key rate by 50 basis points in September, stepping down from the back-to-back 75-bp hikes in June and July. Then he sees 25-bp increases for each meeting until the federal funds rate reaches 3.5%. “And then that’s when I think the Fed’s going to pause,” Sweet said. “They take a deep breath, take a look around, make sure they didn’t break anything in the economy.”

What’s the next economic report to look at? The two economists will be looking at the July personal consumption expenditure number, due to be released on Aug. 26. Sweet expects core PCE will increase by a tenth of a percent month-over-month, slowing from the 0.6% M/M increase seen in June. That will bring the Y/Y growth to 4.6%-4.7%, compared with the 4.8% increase in June.

Several housing reports also come out this week. The August NAHB homebuilder sentiment index, consensus is flat M/M, comes out on Monday and July housing starts and permits (consensus is that both will slip) come out on Tuesday. July existing home sales (also expected to dip) will be released on Tuesday.

While Frick sees some cracks in the housing market, with home price appreciation slowing, “the overarching macro factor of a lot of demand and too few units is going to call the tune for shelter inflation for some time to come.”

SA contributor John M. Mason advises to look at what financial markets are telling us and not just listen to Fed officials.

Image and article originally from seekingalpha.com. Read the original article here.