The Dow Jones Industrial Average (DJIA) is a popular Stock Market Index based on the Top 30 Companies in the United States. The index was created in the late 19th century, and it was intended to measure the share prices of the 30 largest companies. This way, investors would have a way to compare the stock market’s performance by using one easy-to-understand number – the DJIA.

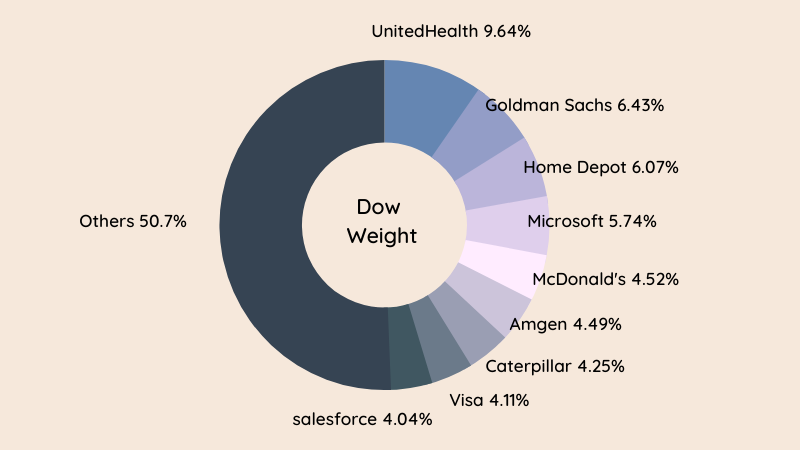

Dow Jones Companies By Weight (2022)

The weighting methodology is based on the price of Dow 30 Stocks adjusted by dividend and stock splits. The weight of Dow 30 Companies is given here per the sectoral classification.

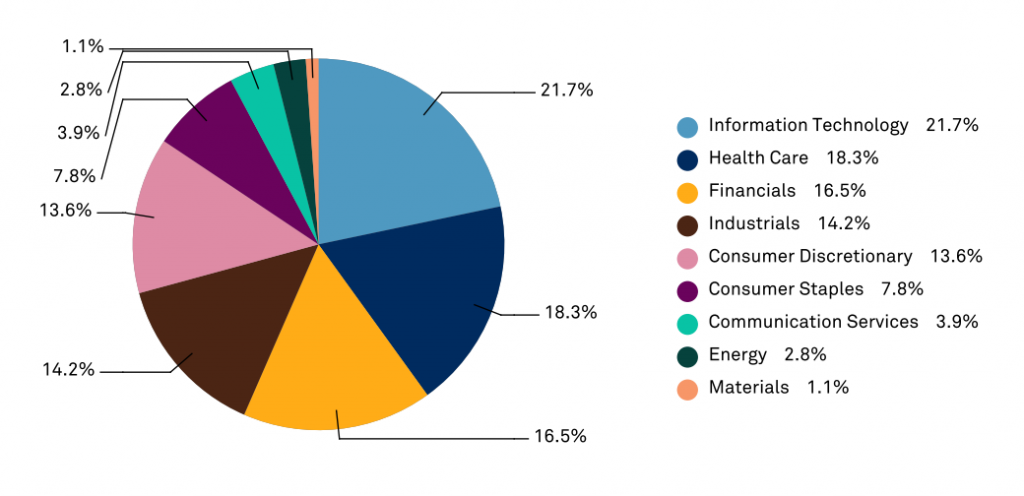

Dow Jones Sector Weight (2022)

More than 50% of the weight is covered by 3 sectors – Information Tech, Health Care, and Financials.

| Sector | Weight |

|---|---|

| #1 Information Technology | 21.7% |

| #2 Health Care | 18.3% |

| #3 Financials | 16.5% |

| #4 Industrials | 14.2% |

| #5 Consumer Discretionary | 13.6% |

| #6 Consumer Staples |

7.8% |

| #7 Communication Services | 3.9% |

| #8 Energy | 2.8% |

| #9 Materials | 1.1% |

Also, Check –

★ Nasdaq 100 Companies by Weight

How to Invest In Dow Jones?

Dow Jones 125 Years Historical Return

Many investors search stock weightage query for index investment propose, divide their portfolio to high weight stock, and buy the stocks accordingly. However, the weight of every stock changes regularly.

Following that change is next to impossible for the general investor. To solve this problem, investors can buy Dow Jones ETF (SPDR Dow Jones Industrial Average ETF Trust) with an expense ratio of 0.16%, which allows them to invest in one click without any complication.